FINANCE SECURITIE GUIDE 2026

- What is meant by Securities?

Answer: Securities (as defined under the Securities Regulation Act 1956) include stocks, shares, bonds debentures or any other similar instruments in or of a body corporate.(FINANCE SECURITIE GUIDE 2026)

2. What is Securities Market?

Answer: It is an institution where securities like shares, bonds, debentures etc. are bought and sold.? be bought and sell can buy and sell securities Explanation: Example 5- Solved security market The place Selling of Shares, Debenture etc.. a trade can Or entering Buying Besides shares it also include Bonds, as per above mentioned in the definition(FINANCE SECURITIE GUIDE 2026)

3. Why Securities market require Regulators?

Answer: Market regulators keep market players in line in a desired direction so that the Securities Markets can function as one of the sources of finance for corporate and government while protecting Investors.(FINANCE SECURITIE GUIDE 2026)

4. Who regulates the Securities Market?

Answer: Department of Economic Affairs, Department Of Company Affairs (DCA), Reserve Bank

Regulating the Bazar at Stock Exchange Answer=SEBI / Appropriate Regulatory Authority in the relevant jurisdiction (FINANCE SECURITIE GUIDE 2026)

5.Key Types of Securities?

Equity: Stocks representing ownership.

Debt: Bonds, debentures (loans to issuers)

. Derivatives: Such as futures, options (value is derived from underlying assets). Hybrid: Combination of both debt and equity. (FINANCE SECURITIE GUIDE 2026)

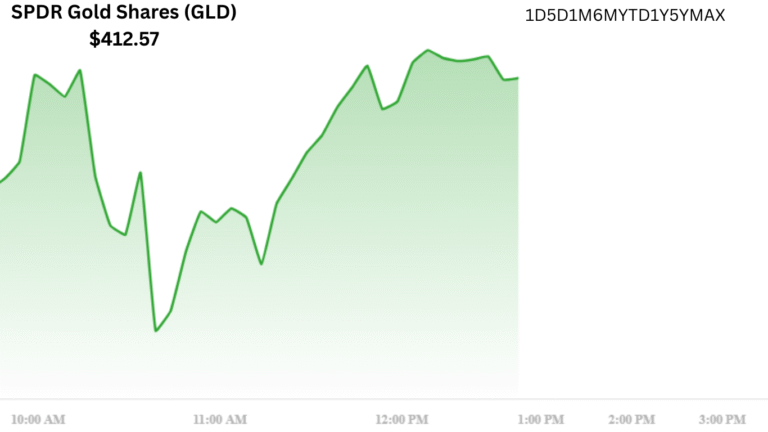

6. How They Work Primary Market?

The market where a new issue of securities is issued (e.g. IPO) in order to raise initial capital. Secondary Market: Where already issued securities are bought and sold among investors (through a stock exchange like NSE/BSE) providing liquidity. Purpose & Regulation Flow of Capital: Direct savings to productive investments. Liquidity: Let investors to cash out. Regulation: By entities such as SEBI (says of India) or SEC (says of US.

7.What are Finance Securities?

Finance securities are tradable financial assets that hold monetary value and can be bought or sold in financial markets. These instruments are regulated by authorities such as SEBI in India to ensure transparency. investor protection, and fair-trading practices. (FINANCE SECURITIE GUIDE 2026)

Securities allow:

Companies to raise funds

Governments to finance development projects

Investors to earn return on their savings

Importance of Finance Securities

Finance securities are crucial for the smooth functioning of financial markets and the economy,

Capital Formation They help companies raise long term capital for expansion and innovation.

Wealth Creation

Investors earn returns through dividends, interest, and capital appreciation.

Liquidity

Securities can be easily bought and sold, providing flexibility to investors,

Risk Management

Diversified securities help reduce finance risk

Role of Securities Market in the Economy

The securities market acts as a bridge between saves and borrowers. It ensures

Efficient allocation of resources

Price discovery through demand and supply

Economic stability and growth

A strong securities market attracts domestic and foreign investment. boosting employment and industrial development.

How to invest in Finance Securities

step1. Understand Your Financial Goals

Define whether your goal is wealth creation, income generation or capital protection.

step 2. Assess Risk Appetite

Choose securities based on your risk tolerance and investment or capital protections.

step3. Open a Demat and Trading Account

A demat account is mandatory for holding securities electronically.

step4 Diversify Your Portfolio

Invest across different asset classes to reduce risk.

step5. Monitor and Review

Risks Associated with Finance Securities

While finance securities offer attractive returns, they also involve risk such as:

Market risk

Credits risk

Interest rate risk

Liquidity risk

Future of Finance Securities

With advancements in technology, finance securities are becoming more accessible througha;

Online trading platforms

Digital bonds

Blockchain based securities

AI – driven investment tools

Conclusion

Finance securities are essential instruments that power the global financial system. Whether you are a student, investor, or finance professional, understanding different types of securities and their role can help you make informed financial decisions, with proper planning, risk assessment, and market knowledge, investing in finance securities can be a powerful way to achieve long – term financial growth.