BITCOIN INVESTMENT GUIDE 2026

BITCOIN INVESTMENT GUIDE 2026

Introductions of Bitcoins

Bitcoins is the world’s first and most popular cryptocurrency, it was launched in 2009 by an anonymous persons or group known as Satoshi Nakamoto. Bitcoin works on blockchain technology. allowing users to send and receive money digitally without the need for banks or intermediaries. over the years, Bitcoin has gained massive popularity as a digital asset, investment options, and alternative financial system.

What is Bitcoin?

Bitcoin is decentralized digital currency that operates one peer – peer network. Unlike traditional currencies issued by govt, Bitcoin is not controlled by any central authority. Transactions are recorded on a public ledger called the blockchain, making the transparent and secure(BITCOIN INVESTMENT GUIDE 2026).

Bitcoin has a limited supply of 21 million coins, which makes it scarce and valuable. This limited supply is one of the main reasons why bitcoin is often compared to gold and called digital gold.

How Bitcoin Works

Bitcoin transactions are verified by network participants called miners, Miners use powerful computers to solve complex mathematical problems, a process known as Bitcoin mining. Once a transaction is verified, it

Each transaction is secure, irreversible, and can be tracked publicly, ensuring trust and transparence in the system.(BITCOIN INVESTMENT GUIDE 2026)

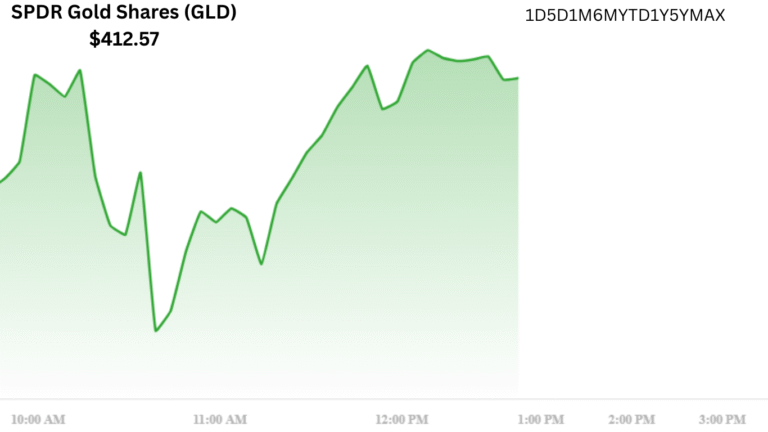

Bitcoin Price and Market Performance

The price of Bitcoin is highly volatile and influenced by factors such as;

Global economic conditions

Government regulations

Institutional adoption

Market demand and supply

Bitcoin has seen massive price growth over the years, attracting traders, investors, and long-term holders. Many investors consider Bitcoin a hedge against inflation and economic uncertainty.

Benefits of Bitcoins

Bitcoins offer several advantages that make it unique

- Decentralization

No central authority controls Bitcoins, reducing the risk of manipulation.

2. Security

Blockchain technology ensures high – level security and protects against fraud.

3. Fast Global Transactions

Bitcoin allows cross – border transactions with lower fees compared to traditional bankig systems.

4. Limited Supply

With only 21 million coins, Bitcoin is resistant to inflation.

5 Investment Opportunity

Bitcoin has emerged as a popular digital investment asset with long-term growth potential

Risks and challenges of Bitcoin

Despite its benefit, Bitcoin also comes with risks.(BITCOIN INVESTMENT GUIDE 2026)

High price volatility

Regulatory Uncertainty

Cybersecurity threats

Lack of widespread acceptance

Investors should always research and understand the risk before investing in Bitcoin,

Bitcoin vs Traditional Currencey

Unlike traditional currencies, Bitcoin is;

Digital only

Borderless

Not Issued by goverments

Based on blockchain technology

Traditional currencies are contralled by central banks, while Bitcoin gives users complets owership of their funds.

Future of Bitcoin

The future of Bitcoin looks promising as more institutions, companies, and govt explore blockchain technology. Bitcoin adoption is increasing in payments, investments, and financial servies. With growing awareness and technology advancement, BItcoin may play a major role in the gloal financial system.

However, regulatory developments and market trends will continue to shape Bitcoin’s future.

Conclusion

Bitcoin has transformed the way people think about money and finance. As the leading cryptocurrency, it offers decentralization, security, and investment potential. While risks exist, Bitcoin continue to gain global acceptance and remains a key player in the digital economy. Whether you are an investor or a technology enthusiast, understanding Bitcoin is essential in today’s financial world.